Important Updates

The Internal Revenue Service is changing 1099-MISC Box 7, "Non-Employee Compensation" to a new form, 1099-NEC. This is effective starting tax year 2020, meaning that when reporting Non-Employee Compensation previously reported in Box 7 for Recipients you Paid in 2020, you will now use form 1099-NEC. E-File Magic supports form 1099-NEC.

Existing Clients

If you previously filed your forms using E-File Magic and wish to Copy Forward recpients from filing year 2019 to 2020, E-File Magic will automatically convert Recipients where you had amounts in Box 7 to

1099-NEC forms when using the "Copy Forward" feature.

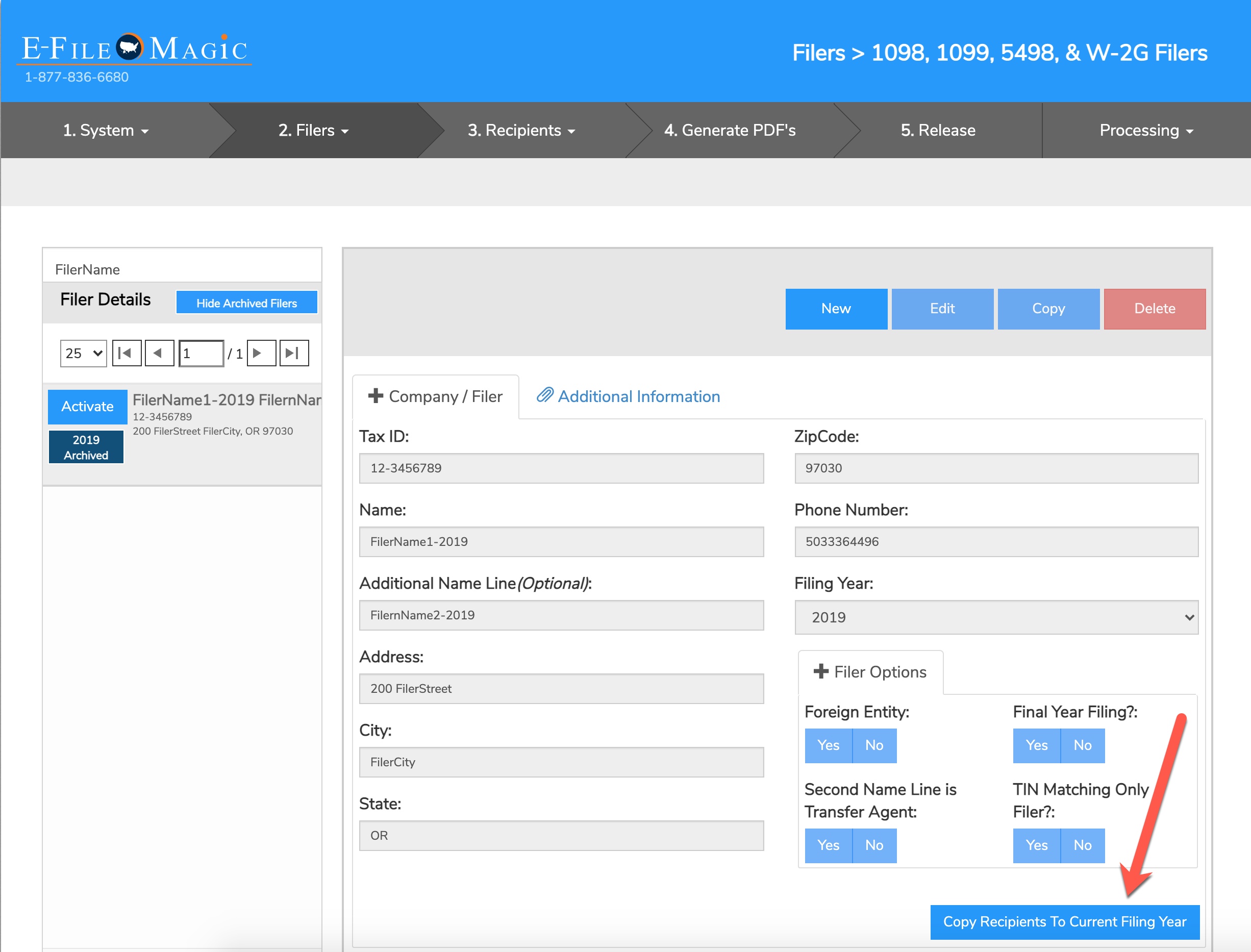

Follow the guide below to copy your recipients forward:

Select Filer

Select a filer and Click on the "Copy Forward" button.

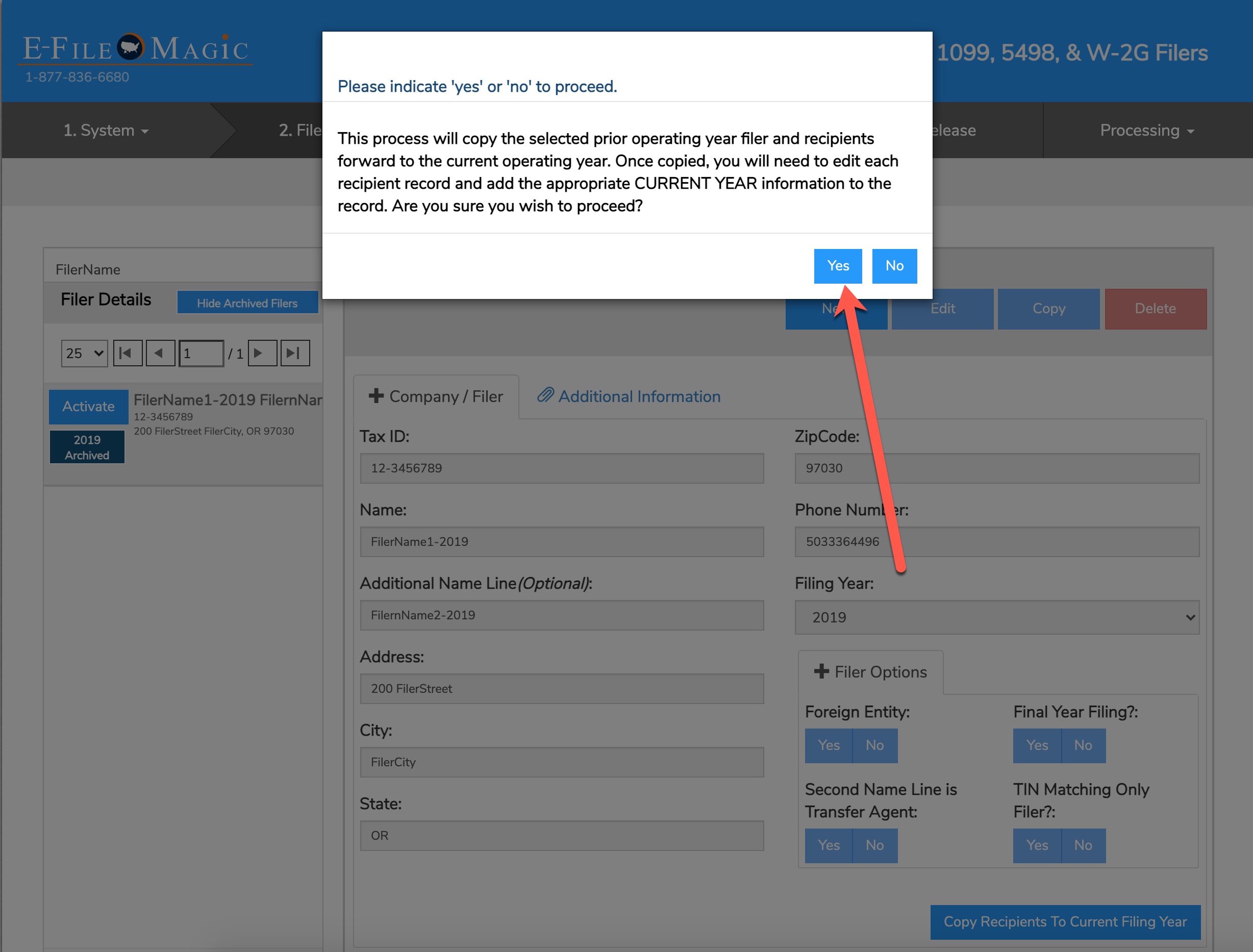

Confirm Copy Forward

Confirm your intent to copy all recipients forward.

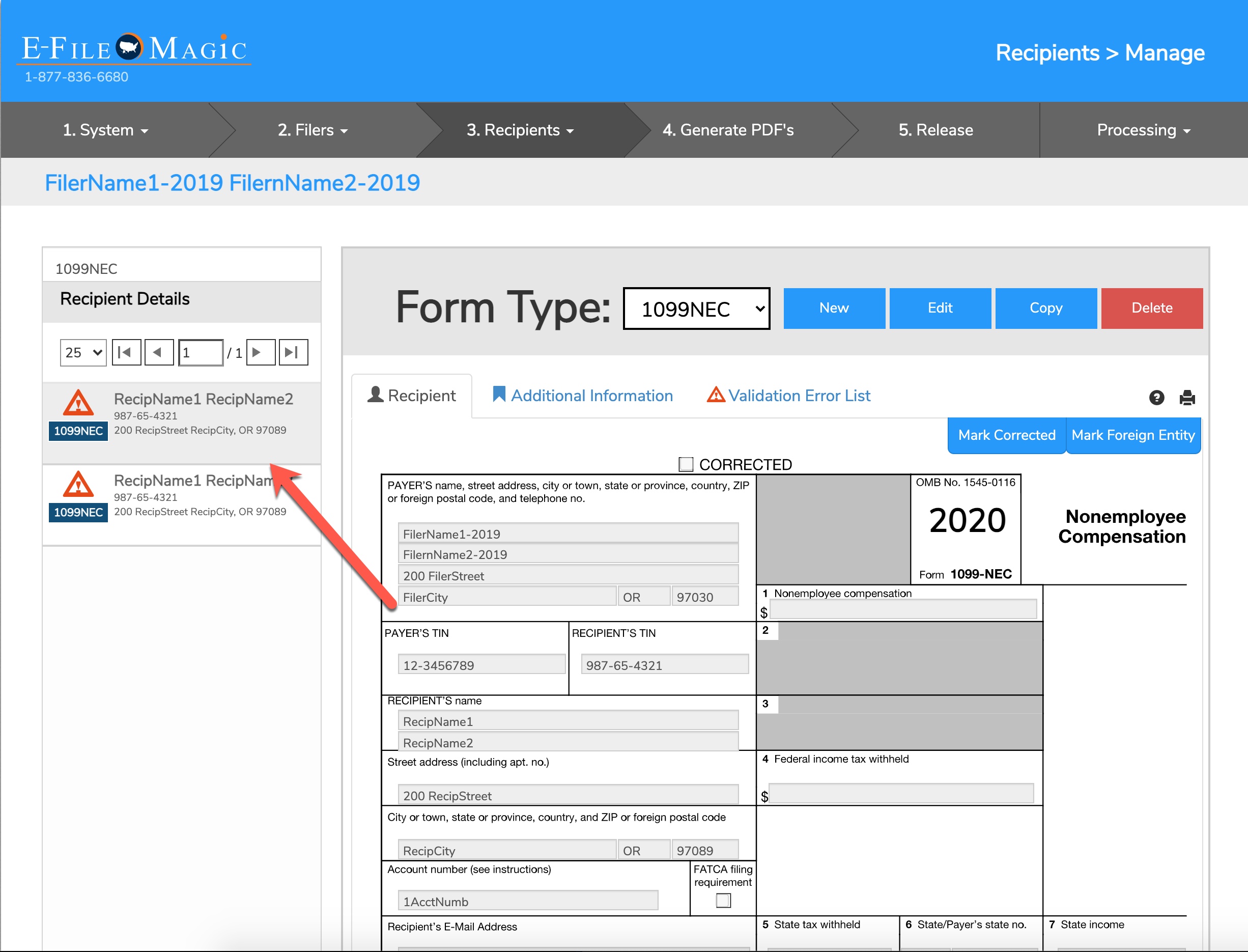

Confirm 1099-NEC Forms

Review and alter your 1099-NEC forms as necessary.

If you intend to import your information from QuickBooks Online or Xero, E-File Magic will allow you to assign a given Non-Employee compensation Vendor/GL Account to Box 1 on the new 1099-NEC Form. If you also wish to import recipients that you are not reporting Non-Employee compensation for from QuickBooks or Xero, E-File Magic will automatically create both 1099-MISC and 1099-NEC forms as necessary.

New Clients

You can Import utilizing our Excel Template, From QuickBooks, Xero, or manually enter new 1099-NEC forms as needed.

State Filing Requirements

The 1099-NEC Form, as of Filing Year 2021 IS currently part of the IRS Combined Federal/State filing program. States not participating in this program may require direct e-filing (generally IF YOU WITHHELD taxes for a given 1099-NEC Recipient) with their online tax reporting portals in addition to Federal e-file. E-File Magic can supply you with a copy of the IRS 1220 Specification file to assist you in meeting your State compliance requirements. Be sure to request this service when releasing your data for processing.

Resources

Review the IRS Instructions for Form 1099-NEC.